As a further illustration of the confidence in Aecon’s continued performance, Aecon’s Board of Directors approved an increase of 16% to the quarterly dividend to 14.5 cents per share from 12.5 cents per share previously.

Over the course of the last few years, we have made substantial progress to deliver consistent performance through scale in core capabilities, end-market diversity and operational excellence. Aecon’s roster of projects is diversified across our key market sectors and well-balanced by both size and duration. Projects awarded in 2018 include:

- The Second Narrows Water Supply Tunnel, Coastal GasLink Pipeline, and Site C Generating Station and Spillways civil works projects all in British Columbia;

- The Peace River Bridge Twinning project in Alberta;

- Spreads 8 and 9 of the Enbridge Line 3 Replacement project in Manitoba;

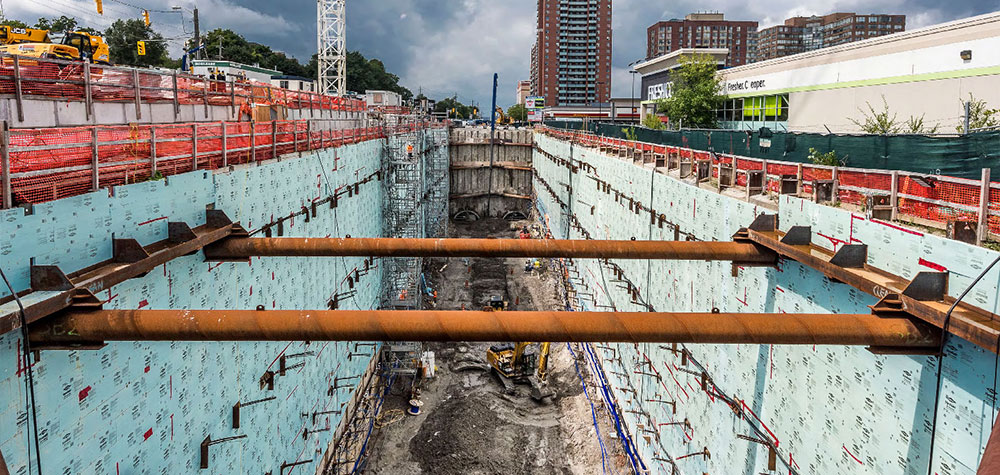

- The Fuel Channel and Feeder Replacement (FCFR) at the Bruce Nuclear Generating Station, Gordie Howe International Bridge, F.G. Gardiner Expressway Rehabilitation (Section 1) and the Finch West Light Rail Transit (LRT) projects all in Ontario; and

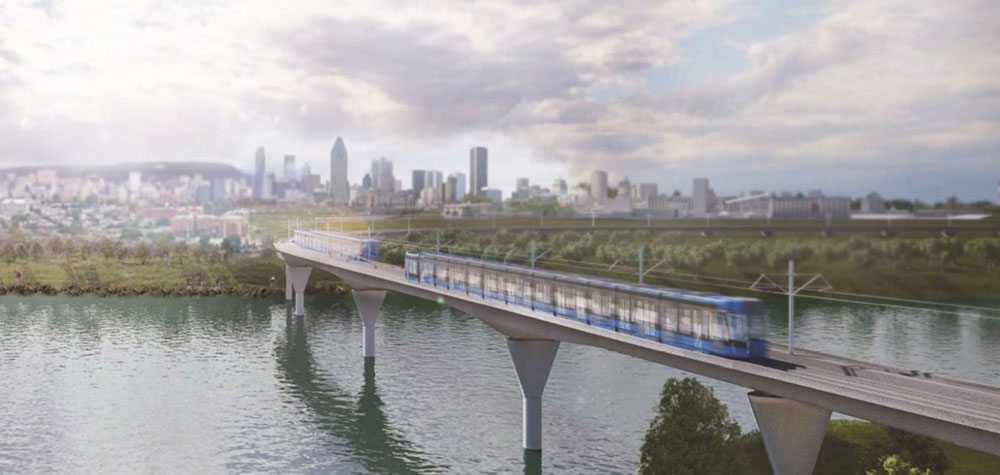

- The Réseau express métropolitain (REM) LRT project in Quebec.

This past year saw Aecon teams across the country and abroad expertly executing some of the most complex projects underway in our industry, including the Bermuda International Airport, the Eglinton Crosstown LRT and the Darlington Nuclear Refurbishment in Ontario, as well as the Annacis Island Wastewater project and the Kemano Generating Station Second Tunnel project, both in British Columbia.

If we were to define the year forward and beyond for Aecon, it would be about FOCUS. Focus on four key priority areas:

- Taking care of our people: Ensuring a safe work environment for all of our people while promoting and living Aecon’s core values with a focus on career development, performance and accountability.

- Improving project efficiency and maximizing profitability: Tackling project complexity, ensuring continuous risk management while maximizing profitability.

- Investing in tomorrow’s growth: Steadily and profitably building our international portfolio, augmenting our services with specialty offerings, while leveraging our ability to self-perform work.

- Balancing agility and process: Ensuring exceptional delivery across projects of all sizes with a focus on executing with precision and enhancing project efficiencies.

As a Canadian leader in construction and infrastructure development with global expertise, we are focused on being the #1 Canadian Infrastructure Company. Simply put, this means we will be the preferred contractor for our clients and the top employer for our people.

Aecon employees are incredibly proud – proud of the projects we build, proud of Aecon’s storied heritage, proud of the positive impact we make in the communities in which we operate, and proud of our first-rate safety culture.

Moving forward, Aecon is well positioned to successfully bid on and deliver major projects stemming from all levels of government and the private sector, and expect steady demand for nuclear refurbishment, utilities, pipelines and conventional industrial work. The Concessions group continues to partner with Aecon’s other segments to focus on the significant number of Public-Private-Partnership opportunities in Canada, and abroad.

For Aecon, the overall outlook remains solid, as our current strong backlog, robust pipeline of future opportunities, and ongoing concessions are expected to lead to an improved Adjusted EBITDA margin.

We remain committed to developing our strong team of people, an unwavering dedication to safety, successful project execution, strong corporate governance, a commitment to social and environmental responsibility, and improving profitability – all focused on increased shareholder value.